Reversing and revising consumption entries on finishing a production order

After posting the output and consumption lines and the status of the production order changed to finished, the system reverses and revises processes if the following criteria are met:

- The By Factor option is selected in the Cost Apportion Method field on the Production Cost Apportionment Setup page.

- When the finished quantity and cost apportion is greater than zero, it exists for more than one production output line in the production order.

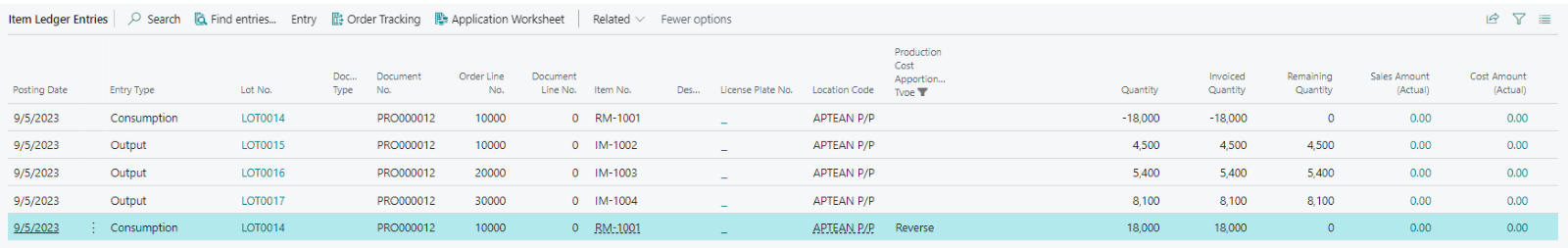

First, the system reverses each consumption posting made by the user. In this example, the 18,000 KG that was posted is reversed using a new item ledger entry of type 'Consumption' but a positive sign. Essentially, this temporarily creates new inventory. In the image below, the selected item ledger entry represents this reversal.

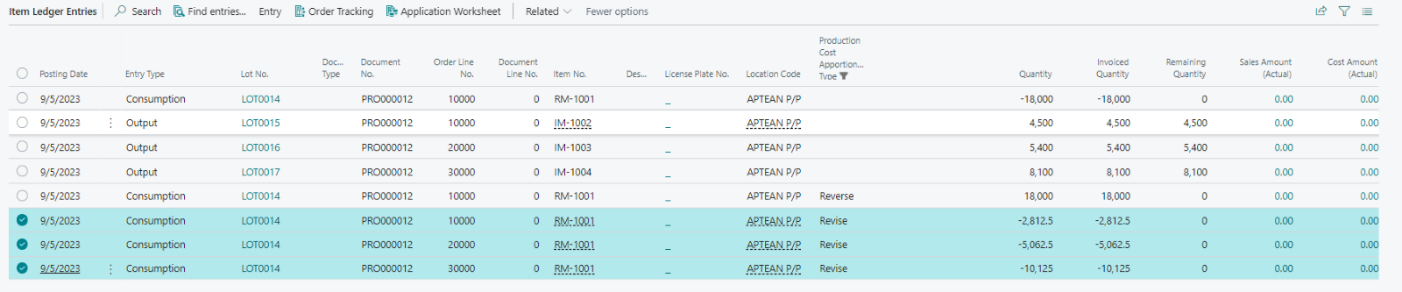

Next, the system redistributes this item ledger entry by creating new item ledger entries of the 'Consumption' type. Each production line meets specific criteria, such as having a finished quantity, a calculated cost apportion ratio, and not being selected to the Include in Cost Apportionment checkbox.

In the example, the 18,000 KG is redistributed among the production lines 10000, 20000, and 30000 using the previously calculated cost apportion ratios as follows:

- Production line 10,000 with item IM-1002 Carrot small, Ratio 0.15625 is allocated 18.000 * 0.15625 = 2812.5 KG

- Production line 20,000 with item IM-1003 Carrot medium, Ratio 0.28125 is allocated 18.000 * 0.28125 = 5062.5 KG

- Production line 30,000 with item IM-1004 Carrot large, Ratio 0.5625 is allocated 18.000 * 0.5625 = 10125 KG

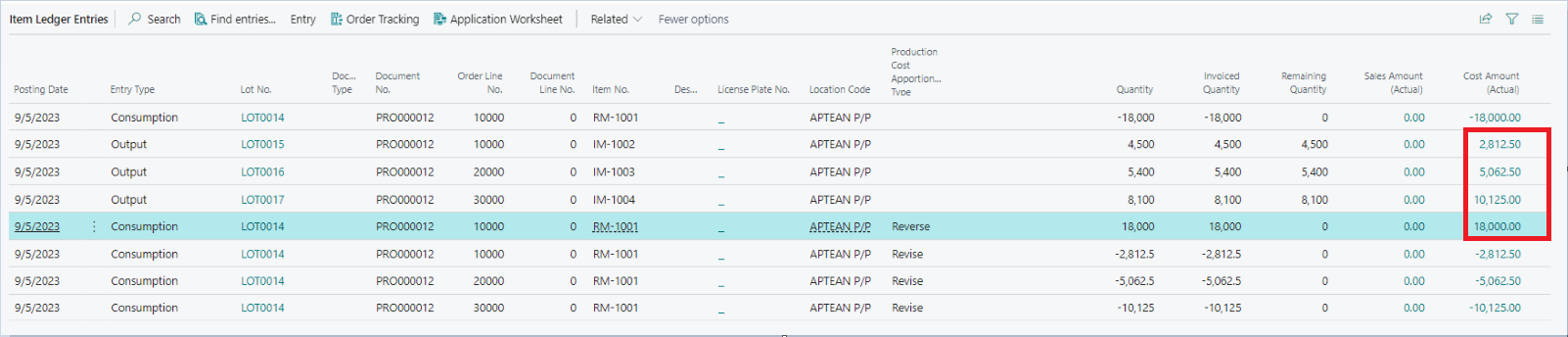

This results in the following total set of item ledger entries for the production order after finishing the Reverse and Revision routine.

Use the Production Cost Apportionment Type field on the Item Ledger Entries and Value Entries pages to view the entries marked as either 'Reverse' or 'Revise'. This helps you distinguish entries created through the reverse/revise process from your posted entries.

When processing a released production order with routing, work center/machine center, and labor time and posting the production journal, the system applies the item's cost apportion factor to calculate the cost apportion ratio for the output quantities.

After finishing the production order, you can view the updated capacity ledger entries, where costs are reversed and revised based on the item's cost apportion ratio.

Understanding the effect of reversing and revising consumption entries

In standard business processes, costs are often distributed evenly among different production lines, regardless of each item's varying value or significance.

However, the Aptean Production Cost Apportionment extension introduces a more sophisticated strategy that incorporates cost apportionment ratios.

Let's continue our carrot example to see how these ratios can impact financial reporting on costing of production items.

Suppose the purchase order, from which our consumption lot originates, is invoiced for a total of 18,000 in local currency (1 LCY per KG). Standard Business Central costing would evenly distribute this purchase value across all production lines based on the quantity produced. The Cost Amount (Actual) field in the corresponding item ledger entries will show the following value:

- Item ledger entry for production line 10,000, Item IM-1002, cost amount actual = (Total purchase value 18,000) / (total output quantity 18,000) * output quantity 4500 = 4500 in local currency Cost per Unit of 1 in local currency

- Item ledger entry for production line 20,000, Item IM-1003 cost amount actual = (Total purchase value 18,000) / (total output quantity 18,000) * output quantity 5400 = 5400 in local currency and Cost per Unit of 1 in local currency

- Item ledger entry for production line 30,000, Item IM-1004 cost amount actual = (Total purchase value 18,000) / (total output quantity 18,000) * output quantity 8100 = 8100 in local currency Cost per Unit of 1 in local currency

This implies that all produced items represent the same value and carry the same cost.

However, by defining cost apportionment factors that vary between items and using the Reverse and Revise Routine, the extension affects how the "Cost Amount (Actual)" and "Cost per Unit" are determined.

In our example, the following factors are assigned per item

- Item IM-1002, Factor 2

- Item IM-1003, Factor 3

- Item IM-1004, Factor 4

This indicates that item IM-1004 is twice as valuable as IM-1002. The Reverse and Revise entries, in conjunction with the standard Business Central Costing mechanism, enforce this costing relationship between output items. The "Cost Amount (Actual)" for the output of our carrot production order becomes:

- Item ledger entry for production line 10.000, Item IM-1002, shows a Cost Amount (Actual) = (Total purchase value 18.000) * production cost apportionment ratio 0.15625 = 2812.50

- Item ledger entry for production line 20.000, Item IM-1003, shows a Cost Amount (Actual) = (Total purchase value 18.000) * production cost apportionment ratio 0.28125 = 5062.50

- Item ledger entry for production line 30.000, Item IM-1004, shows a Cost Amount (Actual) = (Total purchase value 18.000) * production cost apportionment ratio 0.5625 = 10125.00

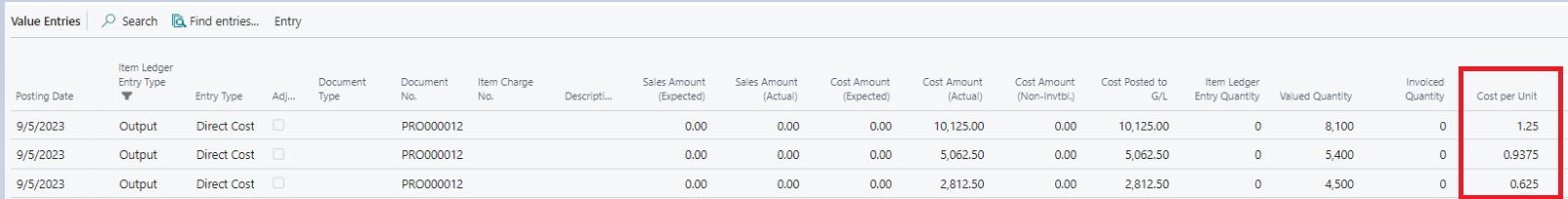

The Cost Amount (Actual), as shown on the item ledger entry, originates from the value entries linked to the item ledger entry of type output. In these value entries, the cost per unit is also maintained.

The "Cost Amount (Actual)" in the item ledger entry originates from the value entries linked to the item ledger entry of type output. These value entries also maintain the cost per unit:

- For Item IM-1002, with a total Cost Amount (Actual) of 2812.50, a Cost per unit of 2812.50 / 4500 = 0.625 is shown.

- For Item IM-1003, with a total Cost Amount (Actual) of 5062.50, a Cost per unit of 5062.50 / 5400 = 0.9375 is shown.

- For Item IM-1004, with a total Cost Amount (Actual) of 10125, a Cost per unit of 10125 / 8100 = 1.25 is shown.

The above explanation demonstrates the effect of the factors defined at the item level. As opposed to the cost apportionment of standard business central, the Aptean Production Cost Apportionment extension is functionality enforces that the valuation of item IM-1004 is twice as high as for item IM-1002.

Whenever modifications are made to the purchase value of the consumed lot numbers (e.g., purchase price corrections, additional costs via item charges), the standard Business Central mechanism of cost adjustment will always allocate these costs to production order output item ledger entries. The existence of the reverse and revised entries ensures that the cost apportionment ratios, originating from the factors defined at the item level, continue to influence how cost adjustments are allocated to production output entries.

To enable this mechanism, all involved items must be set to an actual costing method (the Costing Method field must be set to any options: Fifo, Lifo, or Specific).