Blanket sales order

An extended contract between the client and the vendor is outlined in a blanket sales order. When a customer commits to buying large quantities that will be delivered in multiple smaller shipments over a predetermined period, that is when a blanket order is used.

Create a blanket sales order

-

Select the Search icon

, enter Blanket Sales Order, and then choose the related link.

, enter Blanket Sales Order, and then choose the related link.

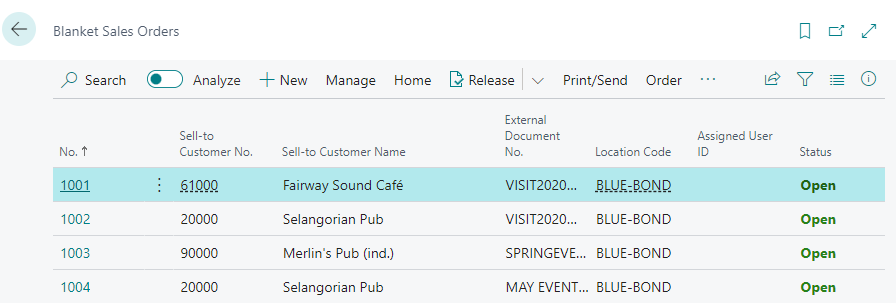

The Blanket Sales Order list page opens.

-

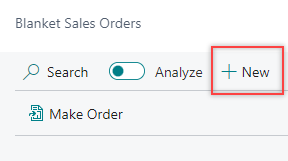

On the action bar, select New.

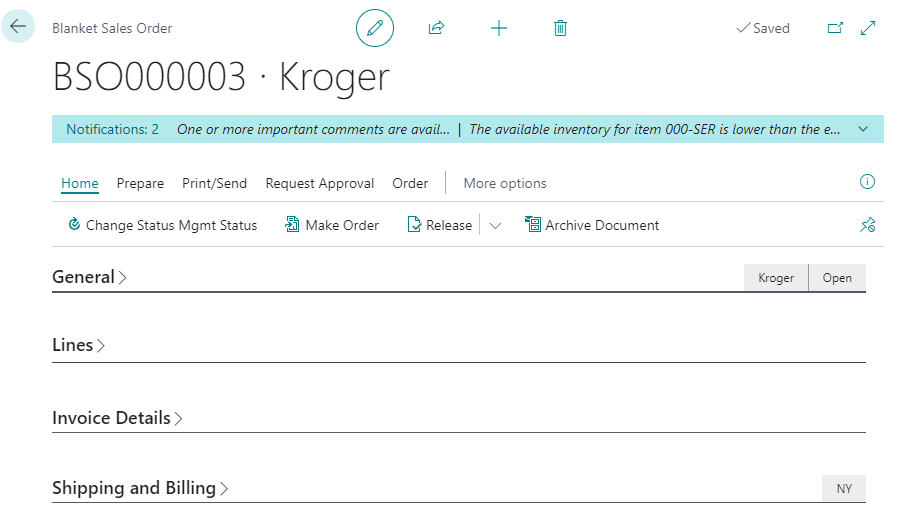

The Blanket Sales Order page opens.

-

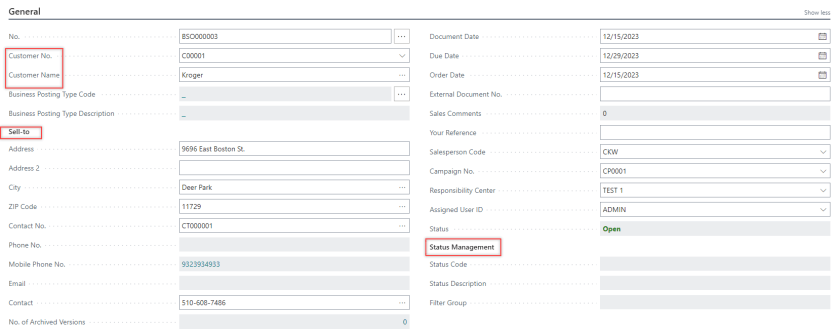

On the General FastTab, select/enter the information in the following fields:

- Customer No. & Name – Specifies the name and number of the customer who will receive the products and be billed by default.

- Sell-To

- Address - Specifies the address where the customer is located.

- Address 2 - Specifies additional address information.

- City - Specifies the city of the customer on the sales document.

- State - Specifies the state, province, or county of the address.

- ZIP Code - Specifies the ZIP code.

- Country/Region Code - Specifies the country or region of the address.

- Contact No. - Specifies the number of the contact person that the sales document will be sent to.

- Phone No. - Specifies the telephone number of the contact person that the sales document will be sent to.

- Mobile Phone No. - Specifies the mobile telephone number of the contact person that the sales document will be sent to.

- Email - Specifies the email address of the contact person that the sales document will be sent to.

- Contact - Specifies the name of the person to contact the customer.

- No. of Archived Versions - Specifies the number of archived versions for this document.

- Document Date - Specifies the date when the related document was created.

- Order Date - Specifies the date the order was created. The order date is also used to determine the prices and discounts on the document.

- Due Date - Type in the due date for the sales invoice.

- External Document No. - Type the customer’s purchase order number specifies a document number that refers to the customer’s or vendor’s numbering system.

- Sales Comments - Specifies the total number of comments that are linked to this document, both on header and on line level.

- Your Reference - Specifies the customer’s reference. The content will be printed on sales documents.

- Salesperson Code - Specifies the name of the salesperson who is assigned to the customer.

- Campaign No. - Specifies the number of the campaign that the document is linked to.

- Responsibility Center - Specifies the code of the responsibility center, such as a distribution hub, that is associated with the involved user, company, customer, or vendor.

- Assigned User ID - Specifies the ID of the user who is responsible for the document.

- Status - Specifies whether the document is open, waiting to be approved, has been invoiced for prepayment, or has been released to the next stage of processing.

- Status Management

- Status Code - Specifies the status management status. Depending on the status, some fields on this card might be blocked or mandatory. Use the Change Status Management Status action to change the status.

- Status Description - Specifies the status management status. Depending on the status, some fields on this card might be blocked or mandatory. Use the Change Status Management Status action to change the status.

- Filter Group - Specifies the status management filter group that is applicable to this sales order, and that determines which status management status codes can be selected for this sales order.

-

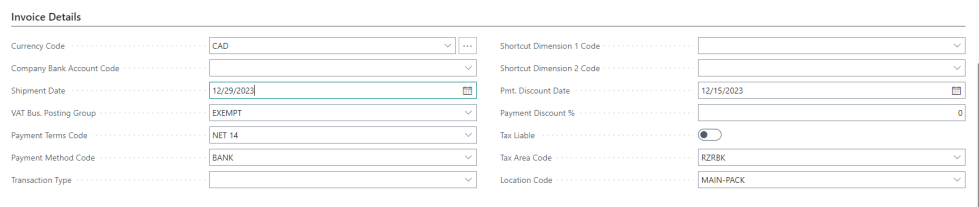

On the Invoice Details FastTab, select/enter the information in the following fields:

- Currency Code - Specifies the currency of amounts on the sales document. If local currency is used, do not enter any value.

- Shipment Date - Specifies when items on the document are shipped or were shipped. A shipment date is usually calculated from a requested delivery date plus lead time.

- VAT Bus. Posting Group - Specifies the tax specification of the involved customer or vendor to link transactions made for this record with the appropriate general ledger account according to the tax posting setup. For European countries only.

- Payment Terms Code - Specifies a formula that calculates the payment due date, payment discount date, and payment discount amount.

- Transaction Type - Specifies the type of transaction that the document represents, for the purpose of reporting to INTRASTAT.

- Tax Liable - Specifies if the customer or vendor is liable for sales tax.

- Tax Area Code - Specifies the tax area that is used to calculate and post sales tax.

- Shortcut Dimension 1 Code - Specifies the code for Shortcut Dimension 1, which is one of two global dimension codes that you set up in the General Ledger Setup page.

- Shortcut Dimension 2 Code - Specifies the code for Shortcut Dimension 2, which is one of two global dimension codes that you set up in the General Ledger Setup page.

- Payment Discount % - Specifies the payment discount percentage granted if the customer pays on or before the date entered in the Pmt. Discount Date field.

- Pmt. Discount Date - Specifies the date on which the amount in the entry must be paid for a payment discount to be granted.

- Location Code - Specifies the location from where inventory items to the customer on the sales document are to be shipped by default.

-

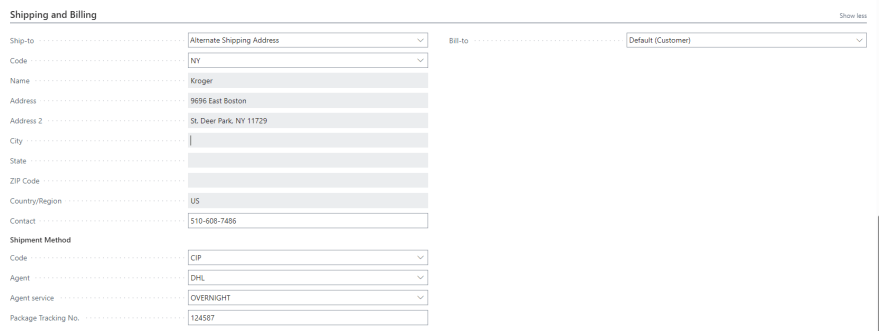

On the Shipping and Billing FastTab, select/enter the information in the following fields:

- Ship-to - Specifies the address that the products on the sales document are shipped to. The Ship-to options are:

- Default (Sell-to Address): The same as the customer’s sell-to address.

- Ship-to Address: One of the customer’s alternate ship-to addresses.

- Custom Address: Any ship-to address that you specify in the fields below.

- Contact - Specifies the name of the contact person at the address that products on the sales document will be shipped to.

- Shipment Method

- Code - Specifies how items on the sales document are shipped to the customer.

- Agent - Specifies which shipping agent is used to transport the items on the sales document to the customer. (Example: FedEx)

- Agent Service - Specifies the code that represents the default shipping agent service you are using for this sales order. (Example: Next day)

- Package Tracking No. - Specifies the shipping agent’s package number.

- Bill-to - Specifies the customer that the sales invoice will be sent to.

- Default (Customer): The same as the customer on the sales invoice.

- Another Customer: Any customer that you specify in the fields below.

- Ship-to - Specifies the address that the products on the sales document are shipped to. The Ship-to options are:

-

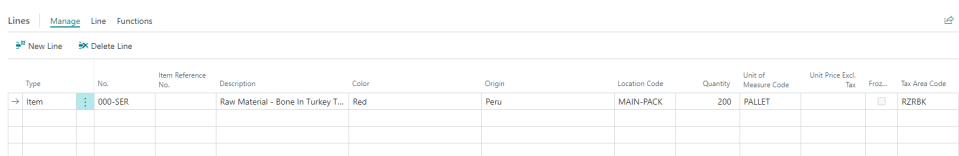

On the Lines FastTab, select/enter the information in the following fields:

- Type - Specifies the type of transaction that will be posted with the document line. If you select Comment, then you can enter any text in the Description field, such as a message to a customer.

- No. - Specifies the number of a general ledger account, item, resource, additional cost, or fixed asset, depending on the contents of the Type field.

- Item Reference No. - Specifies the referenced item number.

- Description - Specifies a description of the entry of the product to be sold. To add a non-transactional text line, fill in the Description field only.

- Color - Specifies the value of global lot attribute 1. This global lot attribute was set up on the Advanced Attribute Setup page.

- Origin - Specifies the value of global lot attribute 2. This global lot attribute was set up on the Advanced Attribute Setup page.

- Quantity - Specifies how many units are being sold.

- Location Code - Specifies the inventory location from which the items sold should be picked and where the inventory decrease is registered.

- Bin Code

- Unit of Measure Code - Specifies how each unit of the item or resource is measured, such as in pieces or hours. By default, the value in the Base Unit of Measure field on the item or resource card is inserted.

- Unit Price Excl. Tax - Specifies the price for one unit on the sales line.

- Frozen - Specifies if Unit Price and Line Discount % of the sales line are frozen. When frozen, it will not change anymore when you adjust for example the order quantity or UoM in the sales line.

- Tax Area Code - Specifies the tax area that is used to calculate and post sales tax.

- Tax Group Code - Specifies the tax group that is used to calculate and post sales tax.

- Line Amount Excl. Tax - Specifies the net amount, excluding any invoice discount amount, that must be paid for products on the line.

- Amount Including Tax - Specifies the sum of the amounts in the Amount Including Tax fields on the associated sales lines.

- Line Discount % - Specifies the discount percentage that is granted for the item on the line.

- Qty to Ship - Specifies the quantity of items that remain to be shipped.

- Qty to Invoice - Specifies the quantity that remains to be invoiced. It is calculated as Quantity - Qty. Invoiced.

- Subtotal Excl. Tax (USD) - Specifies the sum of the value in the Line Amount Excl. Tax field on all lines in the document.

- Inv. Discount Amount Excl. Tax (USD) - Specifies a discount amount that is deducted from the value of the Total Incl. Tax field, based on sales lines where the Allow Invoice Disc. field is selected. You can enter or change the amount manually.

- Invoice Discount % - Specifies a discount percentage that is applied to the invoice, based on sales lines where the Allow Invoice Disc. field is selected. The percentage and criteria are defined on the Customer Invoice Discounts page, but you can enter or change the percentage manually.

- Total Excl. Tax (USD) - Specifies the sum of the value in the Line Amount Excl. Tax field on all lines in the document minus any discount amount in the Invoice Discount Amount field.

- Total Tax (USD) - Specifies the sum of tax amounts on all lines in the document.

- Total Incl. Tax (USD) - Specifies the sum of the value in the Line Amount Incl. Tax field on all lines in the document minus any discount amount in the Invoice Discount Amount field.

Convert to a sales order

-

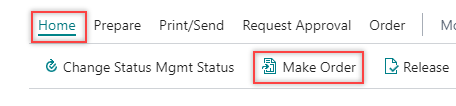

Once the order is released, on the action bar select Home > Make Order.

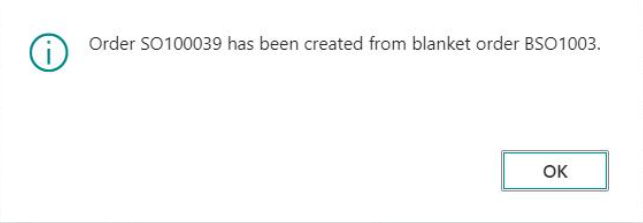

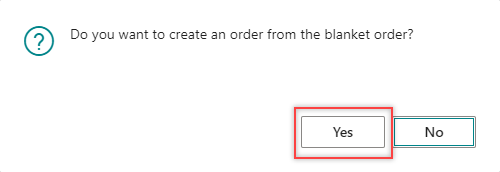

The system displays a dialog box.

-

Click Yes.

A sales order is created from the blanket sales order.