Production order registration: Create output line

A production cost apportionment unit of measure can be set up on the Production Cost Apportionment Setup or the Production Cost Apportionment Items page.

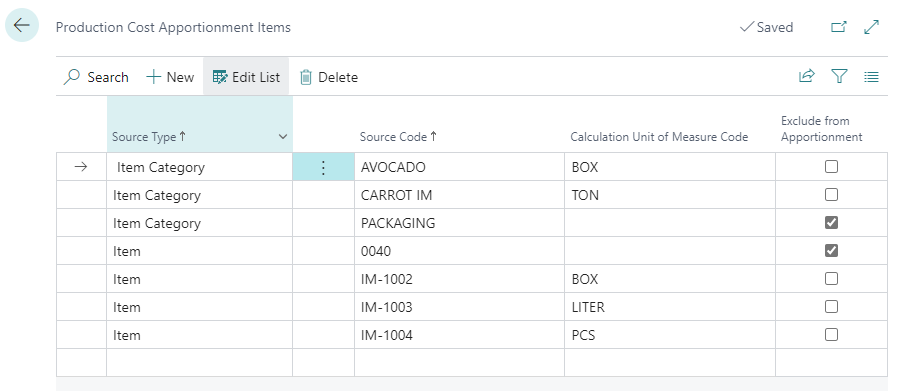

In the following example, assume that you have set the Production Cost Apportionments for the following item category codes and items.

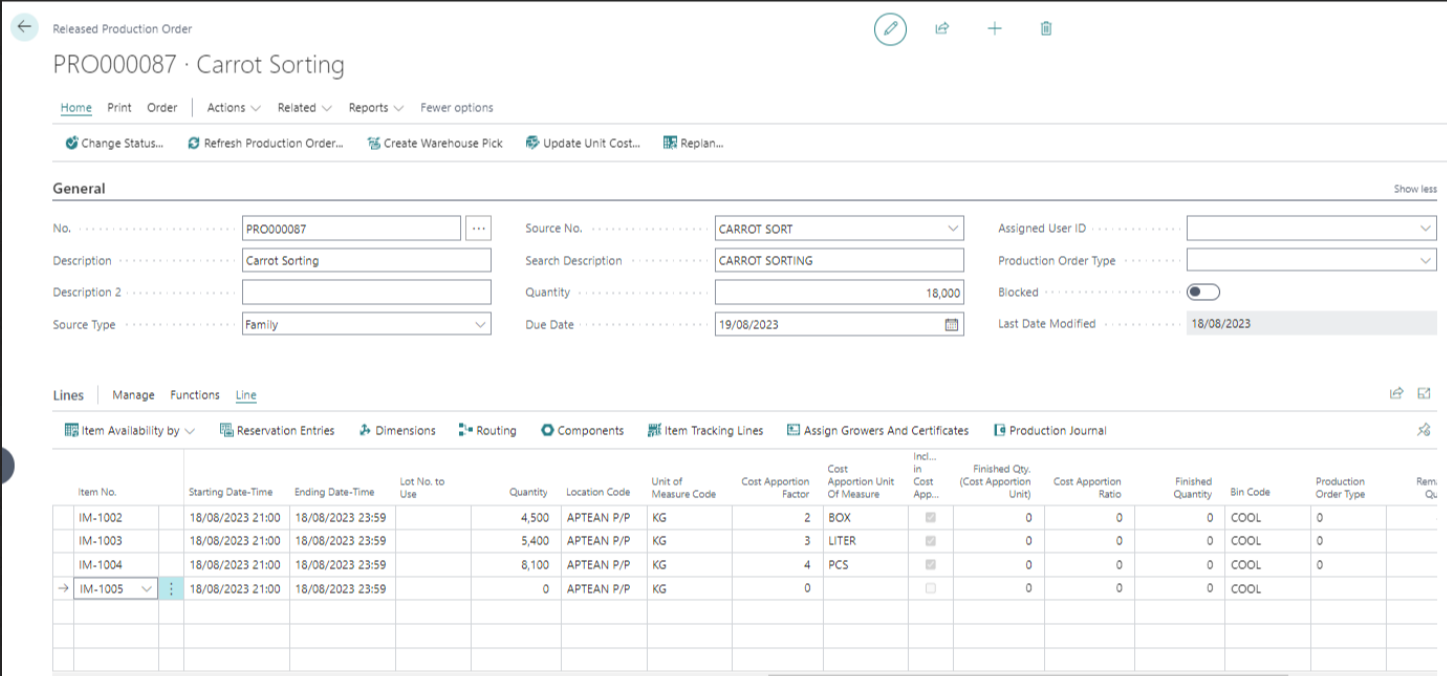

Create a new production order of type sorting or grading, preferably using a family. Upon refreshing the production order, the system generates production lines for each item in the family. Additionally, you can manually add production lines and consumption lines to the order.

- On the Released Production Order page, on the General FastTab, in the Source Type field, specify the value.

- In the Source Number field, specify the number or code.

- In the Quantity field, specify the quantity.

-

On the action bar, select Refresh Production Order to create production lines.

The system displays the factor in the Cost Apportion Factor field of each production line by inheriting the value from the corresponding item card.The cost apportionment features do not apply to a released production order if: - the Consolidated Consumption toggle on the Replenishment FastTab of the associated Item Card page is turned on. This toggle is available only when the Aptean Process Manufacturing extension is installed. - there is a catch weight item in the production order output line. The Catch Weight toggle on the Inventory FastTab of the associated Item Card page must be turned on. This toggle is available only when the Aptean Catch Weight extension is installed.

-

The Cost Apportion UoM field for each production line is filled based on the following conditions:

-

If a record exists where the Source Type is Item and the Source Code matches the item number from the production line on the Item Category Production Cost Apportionment table, the value is taken from that record's Default Calculation UoM field.

-

If there is no record for the item code, but a record exists for the corresponding item category code in the same table. In that case, the value is taken from that record's Default Calculation UoM field.

-

If neither specific item nor item category records exist, the value is filled with the Default Calculation UOM defined on the Production Cost Allocation Setup page.

-

-

For each production output line, the Include in Cost Apportionment checkbox is selected unless a record exists for the corresponding item or item category code in the Item Category Production Cost Apportionment table that states Exclude from Cost Apportionment checkbox is selected.

The Cost Apportion Ratio is initially left blank and is only filled when the production line's output is posted.

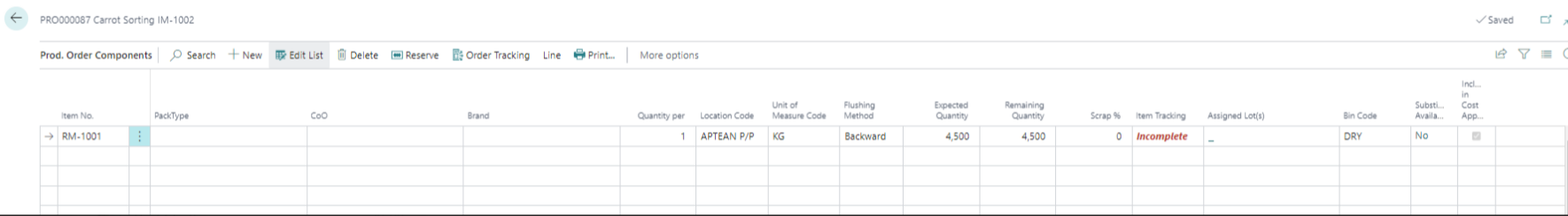

For each production component line, the Include in Cost Apportionment checkbox is selected unless a record exists for the corresponding item or item category code in the Item Category Production Cost Apportionment table that states Exclude from Cost Apportionment checkbox is selected.

Cost Apportion Ratio Calculation on posting output

When you create the production order and post the output quantities in the production order, the system initiates the calculation of the cost apportion ratio. To know how the cost apportion ratio is calculated, see Calculation Cost Apportion Ratio.

The cost apportion ratio is calculated only for production lines with a finished quantity that is selected in the Include in Cost Apportionment checkbox.

Calculation Cost Apportion Ratio

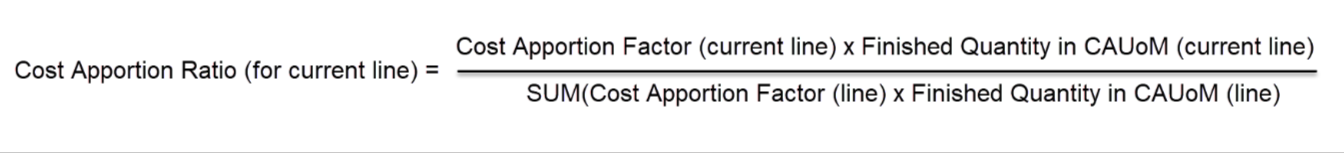

The Cost Apportion Ratio is calculated using the following formula:

To explain how a cost apportion ratio is calculated in the production order line, let us consider an example. Let's say you have created a new production order PRO-001 of the sorting or grading type, preferably using a family. On refreshing the production order, the system generates production lines for each item in the family. Additionally, you can manually add production lines and consumption lines to the order.

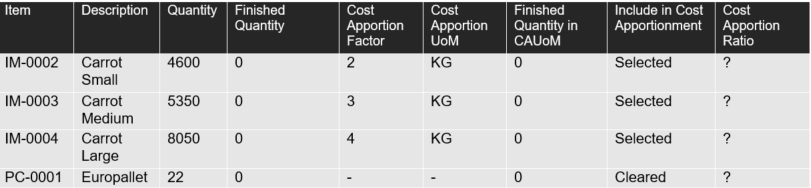

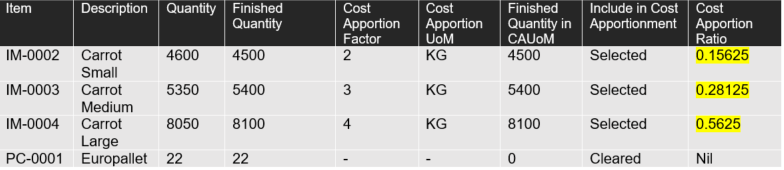

In this example, we have four items (IM-0002, IM-0003, IM-0004, and PC-0001) with corresponding Cost Apportion Factors and quantities.

Execution of Production:

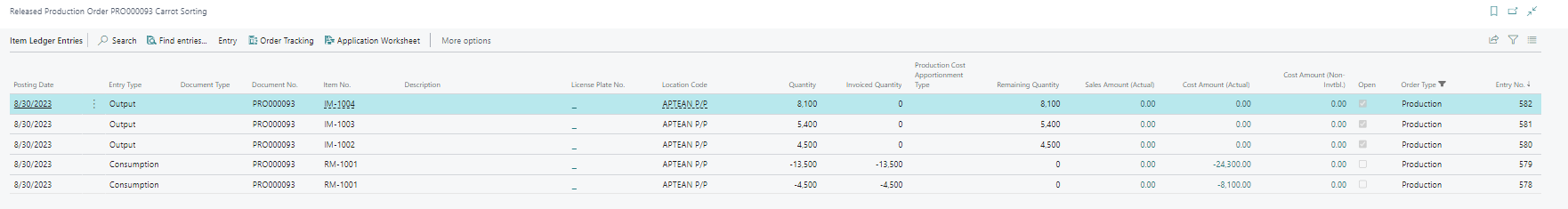

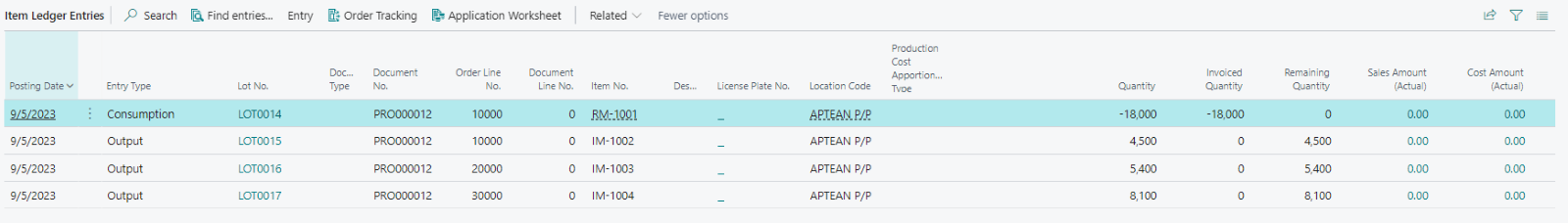

After registering the aforementioned production order, you can post the consumption. Suppose, in this example, a total of 18,000 KG is posted as consumption for the first line. This action results in the subsequent item ledger entry.

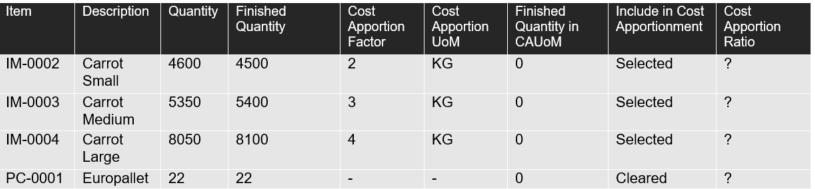

Following the consumption posting, the sorting machine processes the carrots, subsequently registering output for each production output line. Let's assume the Finished Quantities differ from expectations, and the production order updates as follows:

After posting output, the total set of item ledger entries for this production order is the following:

Simultaneously, when posting output, the system will convert the finished quantities to quantities in the Cost Apportion Unit of Measure. For more information, see Setup item for Production Cost Apportionment.

In the provided example, the unit of measure for output posting and the Cost Apportion Unit of measure are both KG. If, for example, the Cost Apportion Unit of Measure for item IM-0001 were TON (equivalent to 1000KG), the finished quantity would be 4500, and the finished quantities in the Cost Apportion Unit of Measure would be set to 4.5.

After conversion to the Cost Apportion Unit of measure, the system will use them to calculate the cost apportion ratio:

Calculating the Cost Apportion Ratio:

The following calculations determine the cost apportion ratios for each respective item.

Calculate for Item IM-0002:

- Cost Apportion Ratio (for IM-0002) = (2 * 4500 kg) / Total of [(2 * 4500 kg) + (3 * 5400 kg) + (4 * 8100 kg)]

- Cost Apportion Ratio (for IM-0002) = 9000 Kg / 57600 ≈ 0.15625

Calculate for Item IM-0003:

- Cost Apportion Ratio (for IM-0003) = (3 * 5400 kg) / Total of [(2 * 4500 kg) + (3 * 5400 kg) + (4 * 8100 kg)]

- Cost Apportion Ratio (for IM-0003) = 16200 Kg / 57600 ≈ 0.28125

Calculate for Item IM-0004:

- Cost Apportion Ratio (for IM-0004) = (4 * 8100 kg) / Total of [(2 * 4500 kg) + (3 * 5400 kg) + (4 * 8100 kg)]

- Cost Apportion Ratio (for IM-0004) = 32400 Kg / 57600 ≈ 0.5625

Calculate for Item PC-0001:

The calculation does not take place for this item since the item has been set to Clear for the Include in Cost Apportionment checkbox on the Production Cost Apportionment Items page. For more information, see Production Cost Apportionment Items.

If the Exclude from Cost Apportionment checkbox is selected or has a zero factor on their Item Card for that specific item, the Cost Apportion Unit of Measure (UoM) will not be populated in the production line. Additionally, such lines will not be considered during processes like reversing/revising.

When posting output for production, the system calculates the cost apportion ratio for each output posting, regardless of whether you post collectively or for specific lines. For instance, if you post output for the initial line, the system calculates the Cost Apportion Ratio specifically for that line. Subsequently, as you post output for the second line, the ratio will be distributed across both lines, updating the cost apportion ratio for each line.