Information about the applied sales price and discount

When creating a sales price line for a customer that is set up with the Advanced Pricing method, the system will apply a price and discount according to the hierarchy mentioned in the previous topic. In the sales price line, the additional Applied Sales Price and Discount page is added to give the user more information about the applied price and discount in the sales price line.

In this example, a sales order line is created for item number "0015", the base unit of measure is a can, and the customer is set up with the Advanced Pricing method. The system automatically calculates the unit price and line discount based on the Advanced Pricing method. The Applied Sales Price and Discount page shows all relevant information about the selected sales price line and sales discount line on which these values are based. The conversion from the unit price on the price line to the unit price on the sales price line is explained by considering the different unit of measures, different currencies and the including/excluding VAT difference.

The Applied Sales Price and Discount page can be opened from the following sales documents:

- Sales order

- Sales return order

- Sales invoice

- Sales credit memo

- Sales quote

-

Blanket sales order

-

For example, on a sales order, on the action bar, select Line > Related Information > Applied Sales Price and Discount.

The page Applied Sales Price and Discount can also be opened by clicking directly on the row button on the sales order line on the Lines FastTab.

- In the Type field, select the context menu

, and then select Applied Sales Price and Discount.

, and then select Applied Sales Price and Discount.

The Applied Sales Price & Discount page has four FastTabs, as explained below:

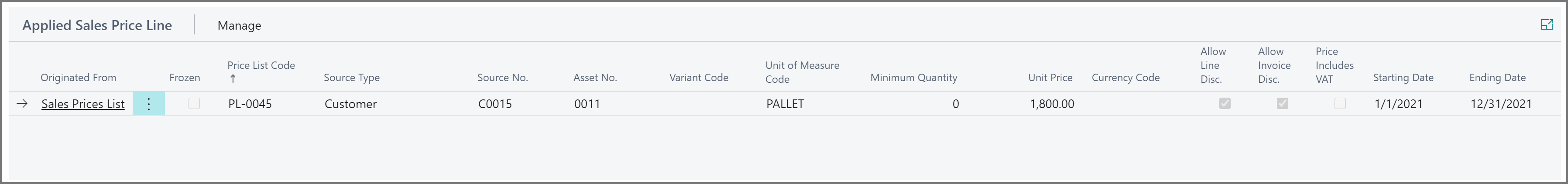

The Applied Sales Price Line FastTab displays the price line that is applied.

| Field | Description |

|---|---|

| Originated From | Specifies where the price line originates from. It could be a price line that was set up in the Sales Prices list, it could be the price from the item card (when no valid sales price line exists), or it could be a price that was manually specified. |

| Frozen | Specifies if the applied sales price line is frozen. When frozen, it will not change anymore when you adjust for example the order quantity or UoM in the sales line. |

| Price List Code | Specifies the price list to which this sales price line belongs. |

| Source Type | Specifies to what type of source this price line applies. It is assigned based on the option selected in the Assign-to Type on the Sales Price List page. |

| Source No. | Specifies the number or the code of the source to which this price line applies. |

| Asset No. | Specifies the number of the item to which this price line applies. |

| Variant Code | Specifies the item variant to which this price line applies. |

| Unit of Measure Code | Specifies the unit of measure of the item. |

| Minimum Quantity | Specifies the minimum quantity required in a sales line for this price line to be valid. The minimum quantity is expressed in the unit of measure of this line. |

| Unit Price | Specifies the sales price of the item/variant expressed per unit of measure of this line. |

| Currency Code | Specifies the currency in which the unit price is expressed. An empty currency code represents the local currency as set up in the General Ledger Setup. The Applied Currency Code field on the sales order, blanket sales order, sales invoice, and sales credit memo will inherit this values based on the selection of customer and item. |

| Allow Line Disc. | Specifies if a possible available line discount may be subtracted from the unit price of this price line. |

| Allow Invoice Disc. | Specifies if a possible available invoice discount may be subtracted from the unit price of this price line. |

| Price Includes VAT | Specifies if the unit price includes VAT. |

| Starting Date | Specifies the date from which this line is valid. |

| Ending Date | Specifies the date until which this line is valid. |

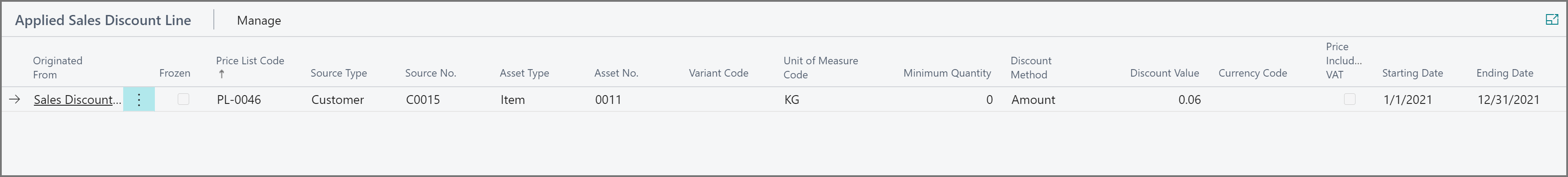

The Applied Sales Discount Line FastTab displays the origin of the discount that is applied.

| Field | Description |

|---|---|

| Originated From | Specifies where the price line originates from. It could be a price line that was set up in the Sales Prices list, it could be the price from the item card (when no valid sales price line exists), or it could be a price that was manually specified. |

| Minimum Quantity | Specifies the minimum quantity required in a sales line for this discount line to be valid. The minimum quantity is expressed in the unit of measure of this line. |

| Discount Method | Specifies whether the discount value is specified as a percentage or as an absolute amount. |

| Discount Value | Specifies the discount that will be granted to the sales line, expressed as a percentage or absolute amount (see Discount Method field). |

| Currency Code | Specifies the currency in which the discount is expressed. An empty currency code represents the local currency as set up in the General Ledger Setup. |

| Price Includes VAT | Specifies if the discount value (absolute amount) includes VAT. |

| Starting Date | Specifies the date from which this line is valid. |

| Ending Date | Specifies the date until which this line is valid. |

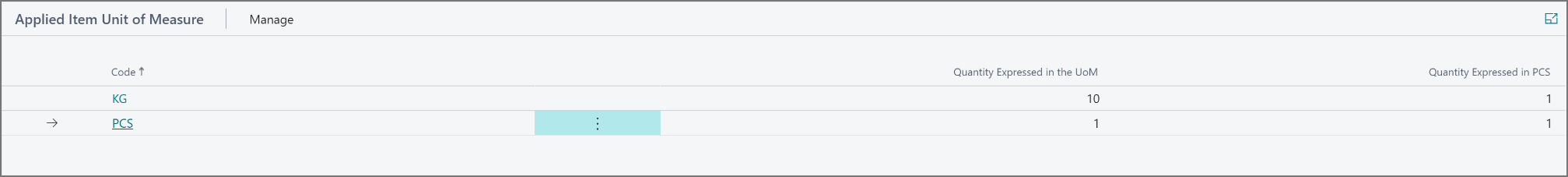

The Applied Item Unit of Measure FastTab displays the unit of measure codes that are used in the applied sales price line, the applied sales discount line, or in the sales document line.

| Field | Description |

|---|---|

| Code | Specifies the unit of measure code that is used in the applied document price line, the applied document discount line or the document line. |

| Quantity Expressed in the UoM | Specifies how many units (expressed in the unit of measure code) are linked to the number of units as specified in the field 'Quantity Expressed in the Base Unit of Measure'. |

| Quantity Expressed in BOX | Specifies how many units (expressed in the base unit of measure) are linked to the number of units as specified in the field 'Quantity Expressed in the UoM' (expressed in the unit of measure code). |

-

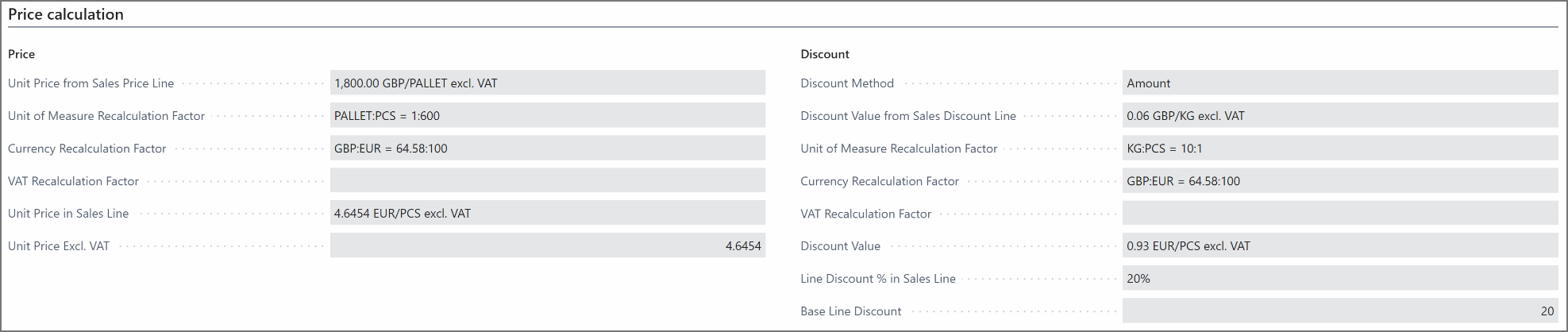

The Price calculation FastTab displays fields related to applied price (Price group) and applied discount (Discount group).

Field Description Unit Price from Sales Price Line Specifies the unit price per unit of measure (incl. or excl. VAT), as set up in the applied sales price line. Unit of Measure Recalculation Factor Specifies the ratio between the unit of measure from the applied sales price line and the unit of measure from the sales document line. This ratio is used to recalculate the unit price from the price line to the unit price on the document line, in case they are specified for different units of measure. Currency Recalculation Factor Specifies the ratio between the currency from the applied sales price line and the currency from the sales document. This ratio is used to recalculate the unit price from the price line to the unit price on the document line, in case they are specified in different currencies. VAT Recalculation Factor Specifies the VAT percentage as set up on the VAT Posting Setup page. This percentage is used to recalculate the unit price from the applied sales price line to the unit price on the sales document line, in case one of them is specified as 'incl. VAT' and the other as 'excl. VAT'. Unit Price (Converted) Calculates the adjusted unit price by applying recalculation factors such as unit of measure (UoM) and currency conversions to the initial unit price from the applied sales price line. This calculation involves multiplying the initial unit price on the sales price line by the item's net weight, resulting in the final converted unit price that reflects accurate pricing based on these adjustments. Discount Method Specifies whether the discount value from the applied sales discount line is specified as a percentage or as an absolute amount. Discount Value from Sales Discount Line Specifies the discount value per unit of measure, as set up in the applied sales discount line. Unit of Measure Recalculation Factor Specifies the ratio between the unit of measure from the applied sales discount line and the unit of measure from the sales document line. This ratio is used to recalculate the discount from the discount line to the discount percentage on the document line, in case they are specified for different units of measure. Currency Recalculation Factor Specifies the ratio between the currency from the applied sales discount line and the currency from the sales document. This ratio is used to recalculate the discount from the discount line to the discount percentage on the document line, in case they are specified in different currencies. VAT Recalculation Factor Specifies the VAT percentage and VAT calculation as set up on the VAT Posting Setup page. This percentage, if applicable based on the VAT calculation type, is used to recalculate the discount from the discount line to the discount on the sales document line, in case one of them is specified as 'incl. VAT' and the other as 'excl. VAT'. Discount Value (Converted) Indicates the discount value derived from the applied sales discount line. This value is calculated by multiplying the item's net weight by the standard discount for regular items. Base Line Discount % Specifies the line discount percentage based on the unit price (converted) and discount amount (converted) of the document line. If the Discount Method field is set to Percentage for the applied line discount, this field displays the discount percentage from the discount line. You can view how the unit price from the sales price line (Unit Price from Sales Price Line field) is converted into the unit price on the sales price line (Unit Price in Sales Price Line field), taking into consideration the unit of measure code and/or the currency code from the applied sales price line can differ from the codes on the sales price line. The same calculation applies if the unit price in the sales price line is expressed including VAT, while the unit price on the sales price line is expressed excluding VAT (or vice versa).

The following fields on the Price Calculation FastTab are displayed only when the Aptean Catch Weight extension is installed.

Field Description Weight Recalculation Factor Defines the ratio between the actual weight of a catch weight item, as recorded on the item tracking lines, and the item's standard net weight. The ratio is determined by dividing the updated weight quantity to invoice specified on the item tracking lines by the standard weight quantity. This recalculated unit price accounts for variations between the item's net weight and actual recorded weight. If the sales order is partially posted, the Weight Recalculation Factor and Unit Price (Converted) by Weight Factor fields will update automatically based on the invoiced weight quantities. Note that the Weight Recalculation Factor field will only display a value if the Update Catch Weight Item Unit Price action is executed or when a document is posted for shipment or invoice. If not, this field will remain empty. Unit Price (Converted) by Weight Factor Determines the unit price adjusted by the weight recalculation factor to reflect the actual price of a catch weight item on the sales line unit of measure. The final unit price is obtained by multiplying the weight recalculation factor and the unit price (converted). Discount Value (Converted) by Weight Factor Indicates the discount value adjusted by the weight recalculation factor to determine the actual discount for the catch weight item based on the weight quantity to invoice and the weight quantity already invoiced as specified in the item tracking lines when the Discount Method field is set to Amount. This value is calculated by multiplying the weight recalculation factor by the discount value (converted). If the Discount Method is set to Percentage for the applied line discount, no value will be displayed in this field.

You can also view these fields on the following pages:

-

Blanket Sales Order

-

Sales Quote

-

Sales Order

-

Sales Order Achieve

-

Sales Invoice

-

Posted Sales Invoice

-

Sales Return Order

-

Sales Credit Memo

-

Posted Sales Credit Memo

The Applied Trade Lines FastTab displays fields related to applied price (Price group) and applied discount (Discount group).

Field Description Trade Base Unit Price (per Sales Price UoM) Specifies the base unit price per sales price unit of measure that is used as the starting point to which trade plan rates are applied. Depending on the set up of the first trade plan line in the trade calculation, this will be either the unit cost of the item or the price that was found in the Sales Price list recalculated to the currency of the sales document. Total Price Increase (per Sales Price UoM) Specifies the sum of all price increases per sales price unit of measure that result from the applied document trade lines. New Unit Price (per Sales Price UoM) Specifies the new unit price per sales price unit of measure. This field is calculated by adding the 'Total Price Increase (per Sales Price UoM)' to the 'Trade Base Unit Price.' Unit Price Excl. VAT Specifies the new unit price per sales price unit of measure. This is the price as shown in the sales line. Total Discount Amount Specifies the sum of all discount values that result from the applied document trade lines, added to the discount value that results from the applied sales discount line. New Line discount % in sales line Specifies the new line discount percentage, as shown in the sales line. This value is calculated by adding the 'Base Line Discount %' (recalculated to an amount using the 'New Unit Price') to the 'Total Discount Amount' and relating this total discount amount to the 'New Unit Price'. The Applied Trade Lines FastTab displays the following fields related to the applied price (Price group) and the applied discount (Discount group) only when the Aptean Trade Management extension is installed.

Field Description Base Discount Value Indicates the discount value derived from the applied sales discount line. For catch weight items, this amount is calculated by multiplying the discount value (converted) by the weight factor and the quantity specified on the sales line. Discount Amount from Trade Lines Indicates the total discount amount accumulated from all the applied document trade lines. This value is calculated by summing the Amount field values from each document trade line with the Price Rule field set as Discount.

For percentage-based discounts, the system displays the discount percentage and recalculates the line discount based on the combined discount amount.

For amount-based discounts, the system shows the discount per unit and adjusts the line discount percentage accordingly.

You can also view these fields on the following pages:

-

Blanket Sales Order

-

Sales Quote

-

Sales Order

-

Sales Order Achieve

-

Sales Invoice

-

Posted Sales Invoice

-

Sales Return Order

-

Sales Credit Memo

-

Posted Sales Credit Memo

The Applied Sales Price Line FastTab shows that the applied sales price is set up with a unit price of 85.75 per crate, without VAT. The currency code in the applied sales price line is empty, which means that the local currency is used for this price, which is, in this case, the currency code GBP. This information is summarized as "85.75 GBP/CRATE excl. VAT" in the Unit Price from Sales Price Line field on this FastTab.

The Unit of Measure Recalculation Factor field on this FastTab specifies the ratio between the unit of measure from the applied sales price line (crate) and the unit of measure from the sales document line (can). In this example, 1 crate contains 20 cans, which is shown in the following manner: "CRATE: CAN = 1:20". This information is taken from the item unit of measure table shown in the third FastTab of this page. This ratio is used to recalculate the unit price from the price line to the unit price on the document line, as they are specified for different units of measure.

The field Currency Recalculation Factor specifies the ratio between the currency from the applied sales price line (local currency) and the currency from the sales document, which is in this case the currency code EUR, which is shown in the following manner: "GBP: EUR = 64.58:100". This ratio is used to recalculate the unit price from the price line to the unit price on the document line, since they are specified in different currencies.

The field VAT Recalculation Factor specifies the VAT percentage as set up on the VAT Posting Setup page. This percentage is used to recalculate the unit price from the applied sales price line to the unit price on the sales document line, since one of them is specified as "incl. VAT" and the other as "excl. VAT".

The explanation of the recalculation for the applied discount (Discount field group) is similar, with the difference that when an absolute value is used as a discount, this amount is recalculated to a percentage.

You can view the global lot attribute and the location code fields along the Applied Sales Price Line and Applied Sales Discount Line of all the sales documents (Sales order, Sales Return Order, Sales Invoice, Sales Credit Memo, Sales Quote, and Blanket Sales Order) only if Aptean Advanced Attributes extension is installed and Attribute Driven Pricing toggle on the Sales Price List page is turned on.

On the action bar, select Actions > Functions to view the following fields:

| Field | Description |

|---|---|

| Get Price | Select which of the available sales price lines, as set up on the page Sales Price, you want to apply to the sales line. |

| Get Line Discount | Select which of the available sales discount lines, as set up on the page Sales Discounts, you want to apply to the sales line. |

| Freeze Price & Discount | Freeze the applied sales price and sales discount. When frozen, they will not change anymore when you adjust for example the order quantity or UoM in the sales line. |

| Unfreeze Price & Discount | Unfreeze the applied sales price and sales discount. When unfrozen, the system will automatically update them every time you change for example the order quantity or UoM in the sales line. |

| Manual Price | Register the manual sales price (Alt+S). |

| Manual Discount | Register the manual sales discount (Alt+D). |