Purchases and payables setup

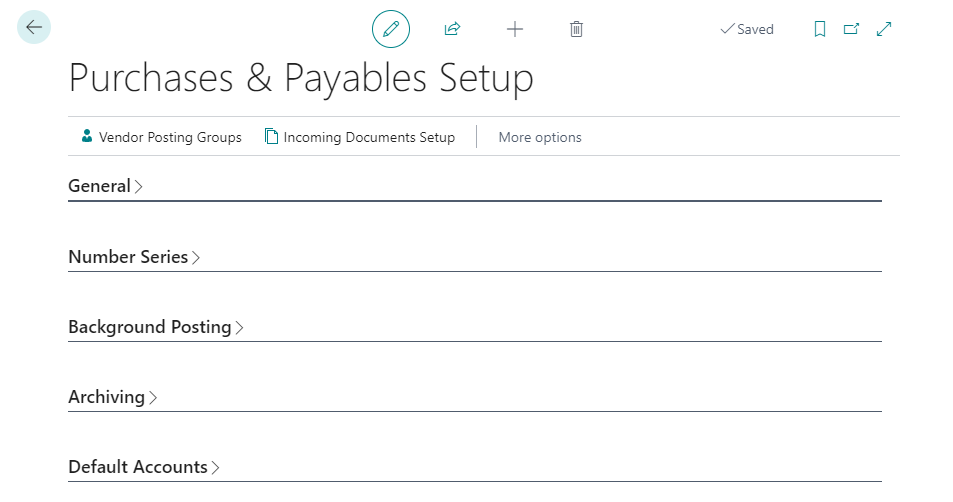

This guide provides an overview of the fields and configuration options within the Purchases & Payables Setup page. On this page, you can define how purchases and outgoing payments are processed. This setup is rarely configured, and only the mandatory fields are explained. However, if any issues arise or modifications are needed, you can adjust the necessary settings as required.

-

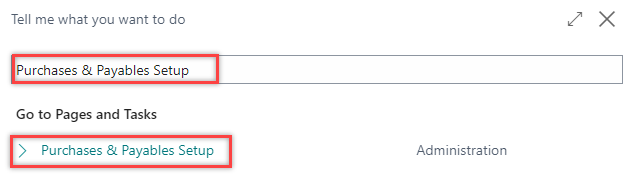

Select the Search icon

, enter Purchases & Payables Setup, and then choose the related link.

, enter Purchases & Payables Setup, and then choose the related link.

The Purchases & Payables Setup page opens.

-

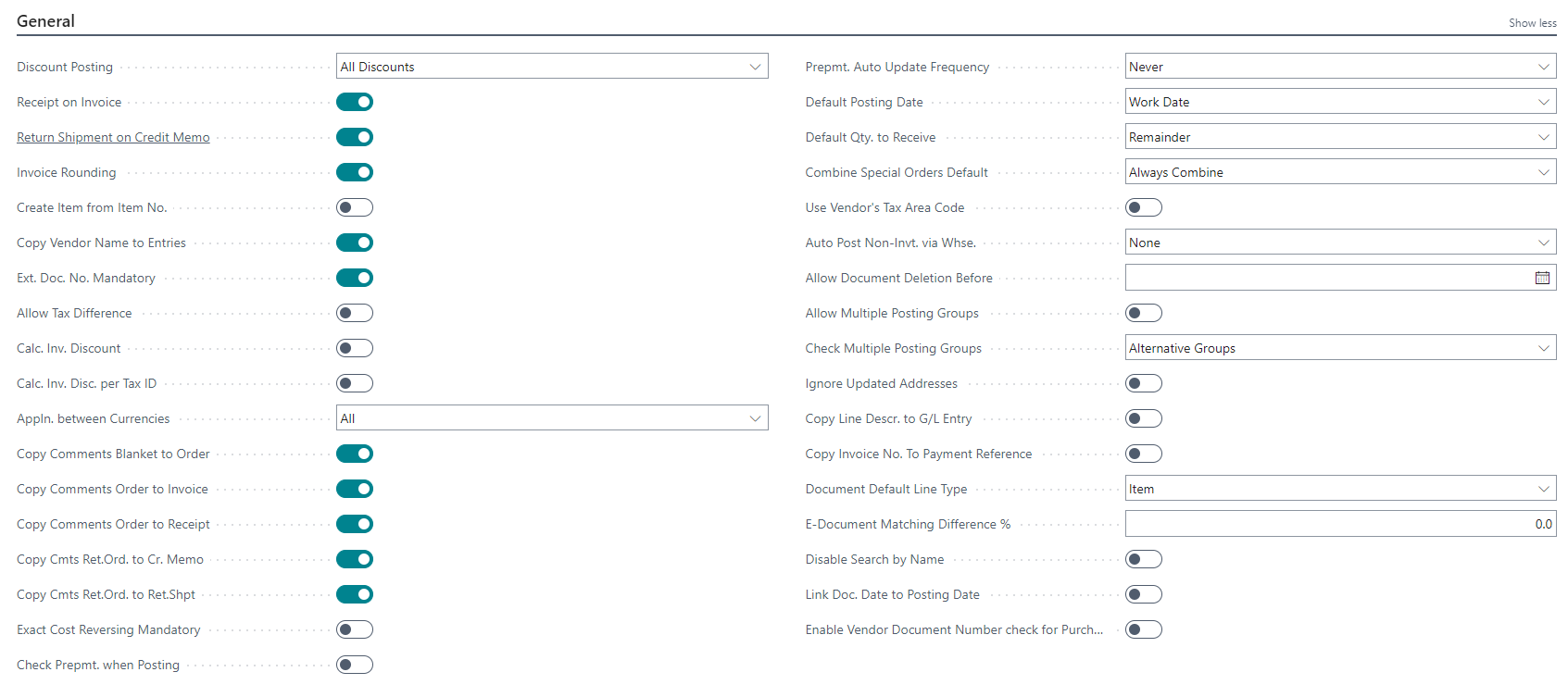

On the General FastTab, enter/select the following fields:

-

Discount Posting – Select the type of purchase discounts to post separately. The available options are as follows:

- No Discounts – Select this option to subtract the discount before posting, instead of posting the discounts separately.

- Invoice Discounts – Select this option to post the invoice discount and invoice amount simultaneously, based on the Purch. Inv. Disc. Account field on the General Posting Setup page.

- Line Discounts – Select this option to post the line discount and invoice amount simultaneously, based on the Purch. Line Disc. Account field on the General Posting Setup page.

- All Discounts – Select this option to post the invoice, line discounts, and the invoice amount simultaneously, based on the Purch. Inv. Disc. Account and Purch. Line Disc. Account fields on the General Posting Setup page.

-

Receipt on Invoice – Turn on this toggle to automatically create posted receipt documents when posting purchase invoices. If this option is not selected, only posted invoices are created.

-

Return Shipment on Credit Memo – Turn on this toggle to automatically create a posted return shipment and a posted purchase credit memo when a credit memo is posted.

-

Invoice Rounding – Turn on this toggle to round amounts for purchase invoices. Rounding is applied as specified in the Inv. Rounding Precision ($) field on the General Ledger Setup page.

-

Create Item from Item No. – Turn on this toggle to suggest creating a new item if no matching item number is found in the No. field on purchase lines.

-

Copy Vendor Name to Entries – Turn on this toggle to copy the name on vendor cards to vendor ledger entries during posting.

-

Ext. Doc. No. Mandatory – Turn on this toggle to make it mandatory to enter an external document number in the External Document No. field on a purchase header or a general journal line.

-

Allow Tax Difference – Turn on this toggle to allow the manual adjustment of tax amounts in purchase documents.

-

Calc. Inv. Discount – Turn on this toggle to automatically calculate the invoice discount amount in purchase documents. This is based on the Allow Invoice Disc. checkbox value on the purchase lines.

-

Calc. Inv. Disc. Per Tax ID – Turn on this toggle to calculate the invoice discount according to the tax identifier defined in the tax posting setup. If you turn off this toggle, the invoice discount will be calculated based on the invoice total.

-

Appln. Between Currencies – Select the option to allow applying vendor payments in different currencies. The available options are:

- None – All entries involved in one application must be in the same currency.

- EMU – You can apply entries in euro and one of the old national currencies (for EMU countries/regions) to one another.

- All – You can apply entries in different currencies to one another. The entries can be in any currency.

-

Copy Comments Blanket to Order – Turn on this toggle to copy comments from blanket purchase orders to purchase orders.

-

Copy Comments Order to Invoice – Turn on this toggle to copy comments from purchase orders to purchase invoices.

-

Copy Comments Order to Receipt – Turn on this toggle to copy comments from purchase orders to receipts.

-

Copy Cmts Ret. Ord. to Cr. Memo – Turn on this toggle to copy comments from purchase return orders to purchase credit memos.

-

Copy Cmts Ret. Ord. to Ret. Shpt. – Turn on this toggle to copy comments from the purchase return order to the posted return shipment.

-

Exact Cost Reversing Mandatory – Turn on this toggle to ensure that a return transaction cannot be posted unless the Appl.-to Item Entry field on the purchase order line specifies an entry.

-

Check Prepmt. When Posting – Turn on this toggle to prevent receiving or invoicing an order with an unpaid prepayment amount.

-

Prepmt. Auto Update Frequency – Select the frequency for the job to automatically update the status of orders pending prepayment. The available options are Never, Daily, and Weekly.

-

Default Posting Date – Select the default posting date to be used on purchase documents. The available options are Work Date and No Date.

-

Default Qty. to Receive – Select the default value for the Qty. to Receive field on purchase order lines and the Return Qty. to Ship field on purchase return order lines. The available options are Remainder and Blank. If you choose Blank, the quantity to invoice is not automatically calculated.

-

Use Vendor’s Tax Area Code – Turn on this toggle to specify the source of the tax area code for purchase sales tax calculations. The tax area code, combined with the tax group, determines how sales taxes are calculated and posted.

-

Allow Document Deletion Before – Select or enter the date when posted purchase invoices and credit memos can be deleted. If you enter a date, posted purchase documents with a posting date on or after this date cannot be deleted.

-

Ignore Updated Addresses – Turn on this toggle to copy address changes made on purchase documents to the vendor card. By default, changes are copied to the vendor card.

-

Copy Line Descr. To G/L Entry – Turn on this toggle to carry the description on document lines of G/L account type to the resulting general ledger entries.

-

Copy Invoice No. To Payment Reference – Turn on this toggle to copy the value of the Vendor Invoice No. field to the Payment Reference field during posting, unless the Payment Reference field is not blank.

-

Document Default Line Type – Select the default value for the Type field on the first line in new purchase documents. If required, you can change the value on the line. The available options are blank, G/L Account, Item, Resource, Fixed Asset, Charge (Item), and Allocation Account.

-

Enable Vendor Document Number check for Purchase Documents – Turn on this toggle to ensure that the external vendor document number check is performed to prevent duplicate purchase documents.

-

-

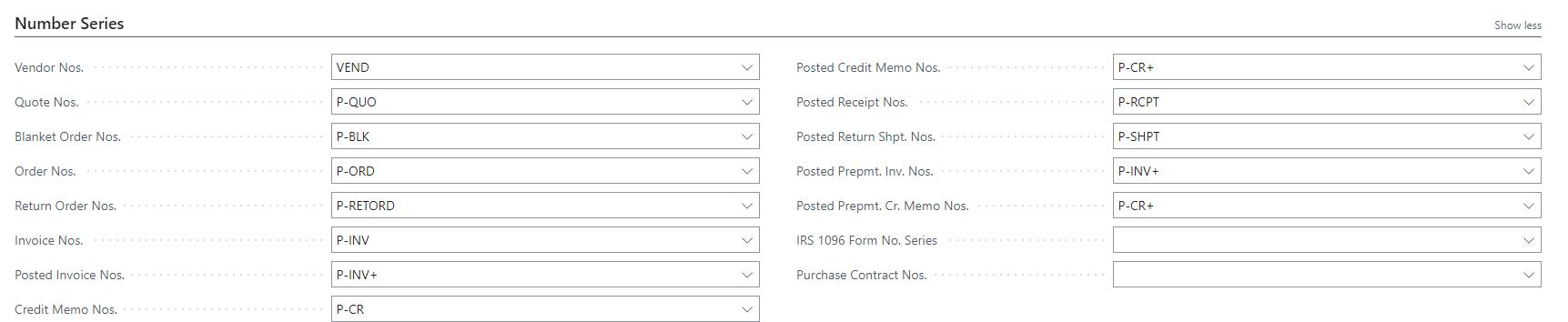

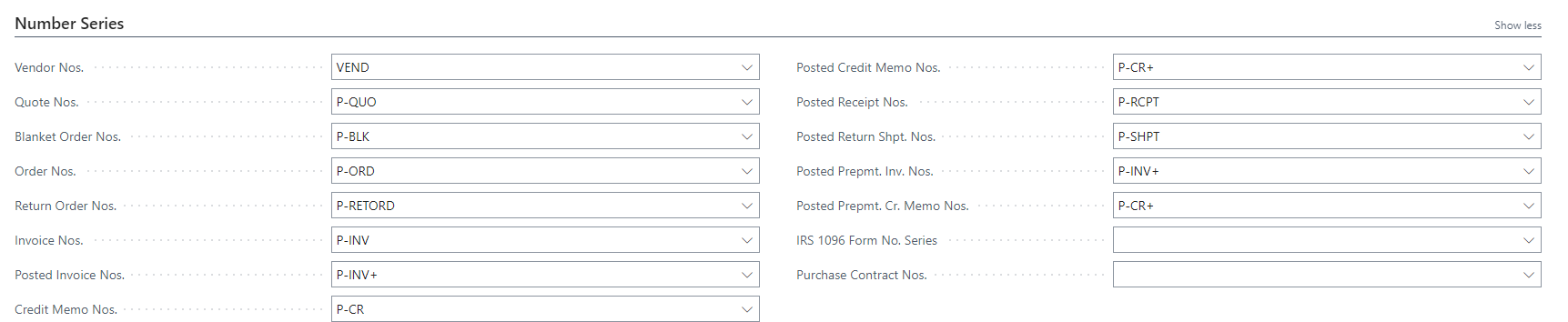

On the Number Series FastTab, select the required field values to configure the number series that are to be used for your different purchase documents.

-

On the Background Posting FastTab, enter/select the following fields:

- Post with Job Queue – Turn on this toggle to use job queues in the background to post documents, including orders, invoices, return orders, and credit memos.

- Post & Print with Job Queue – Turn on this toggle to enable job queues for posting and printing purchase documents in the background as part of your business process.

- Job Queue Category Code – Select the code for the category of the job queue that you want to associate with background posting.

- Notify on Success – Turn on this toggle to ensure a notification is sent when posting and printing is successfully completed.

- Report Output Type – Select the output type of the report that will be scheduled with a job queue entry when the Post and Print with Job Queue check box is selected. The available options are PDF and Print.

-

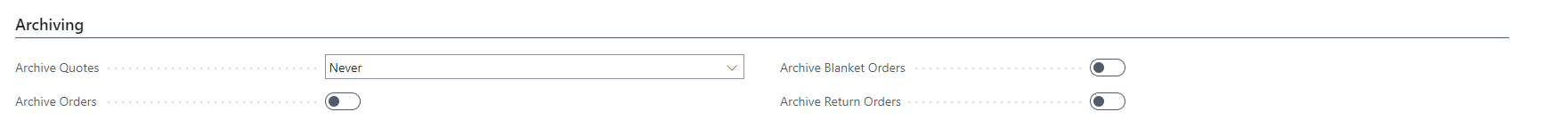

On the Archiving Posting FastTab, enter/select the following fields:

- Archive Quotes – Select how you want to archive purchase quotes when they are deleted. The available options are Never, Question, and Always.

- Archive Orders – Turn on this toggle to archive purchase orders when they are deleted.

- Archive Blanket Orders – Turn on this toggle to archive purchase blanket orders when they are deleted.

- Archive Return Orders – Turn on this toggle to archive purchase return orders when they are deleted.

-

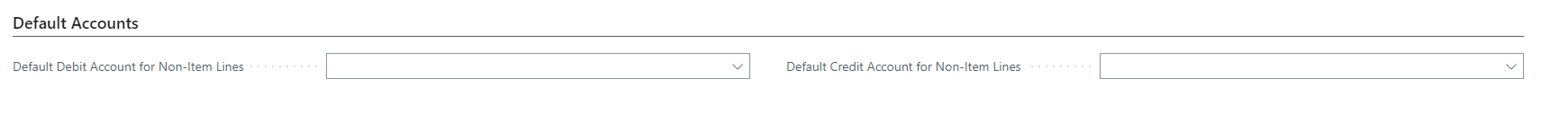

On the Default Accounts FastTab, enter/select the following fields:

- Default Debit Account for Non-Item Lines – Select the G/L account that is automatically inserted on purchase lines of Debit type that are created from electronic documents when the incoming document line does not contain an identifiable item. Any incoming document line that does not have a GTIN or the vendor’s item number will be converted to a purchase line of G/L Account type, and the No. field on the purchase line will contain the account that you select in the G/L Account for Non-Item Lines field.

- Default Credit Account for Non-Item Lines – Select the G/L account that is automatically inserted on purchase lines of Credit type that are created from electronic documents when the incoming document line does not contain an identifiable item. Any incoming document line that does not have a GTIN or the vendor’s item number will be converted to a purchase line of G/L Account type, and the No. field on the purchase line will contain the account that you select in the G/L Account for Non-Item Lines field.