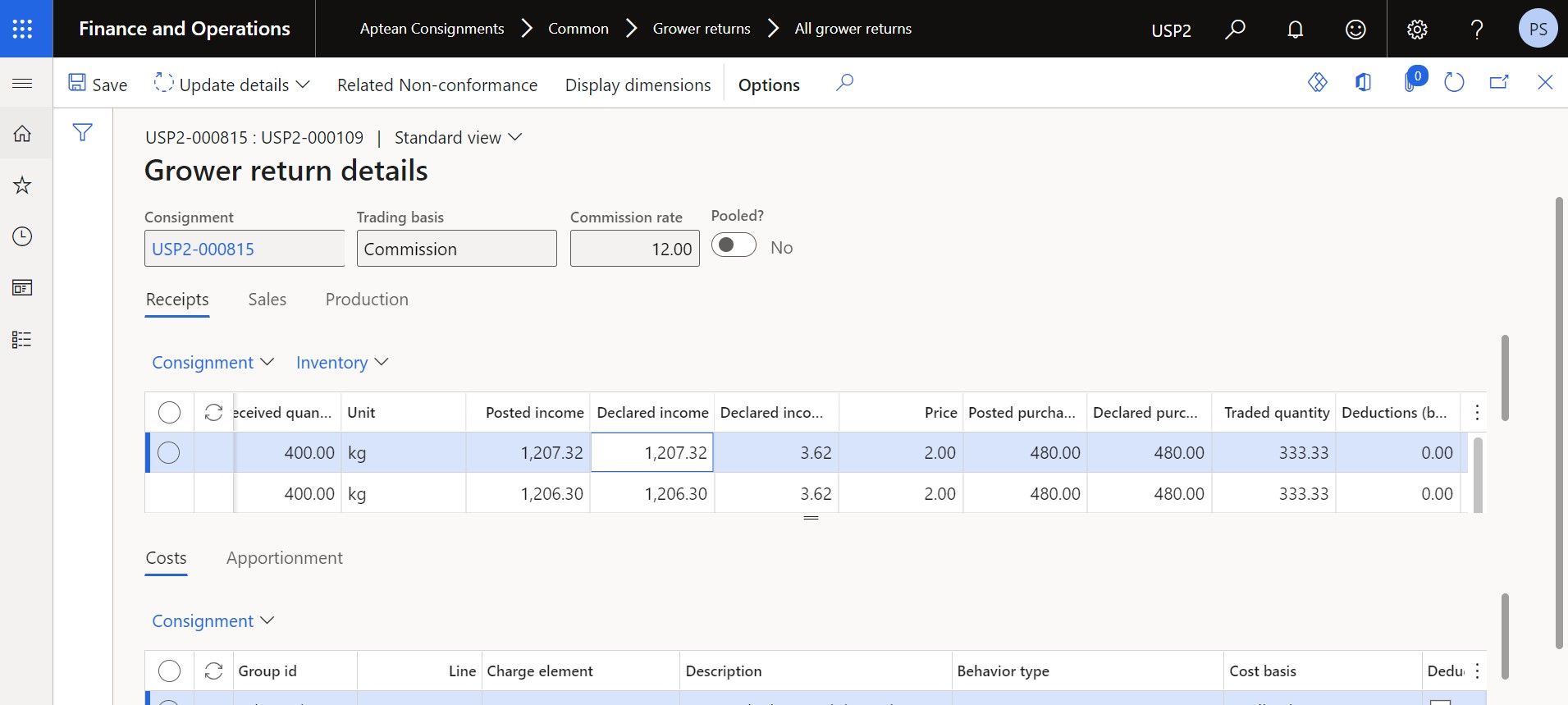

Consignment grower return line

This is the main working area for grower returns. You use this form to view details of the received grower return lines and associated cost information. You can see an overview of the costs which are initially determined according to the assigned template and the costs basis. As required, you can manipulate the figures and add new charges to affect the declared costs and final grower return payback figures irrespective of the actual costs.

Use the Inventory option on the menu to control the dimensions displayed.

You can double click any of the cost items on the grower return lines to display a filtered list of all the related costs taken from consignment ledger entries.

Costs overview

Apart from the header details of the grower return, the Costs tab provides details of costs and charges, including their apportionments that arise from consignments purchase orders and so on. You can manipulate the costs and apportionments as required. You can also add new lines for costs or charges and amend the declared value of costs that will determine the final payback.

Costs apportionment

In order to provide the correct pay-back calculation, apportionment of charge lines results in appropriate adjustments to each of the raw material lines. For all the costs that need to be deducted, the values are not necessarily apportioned equally.

For example, duty may be on bananas but not pineapples, so the apportionment of the duty charge should only apply to bananas. The original apportionment from the consignment charge lines is taken into account.

As the grower return is created, a table is updated with charges from the consignment charge lines for forecast and consignment ledger entries for actual or realized.

Production

The Production tab shows the production orders attached to the currently selected raw materials cost line. You can view the details for all grower returns regardless of trading basis, but you can only manipulate the return for the grade-out and pack-out trading basis calculation.

Sales

With the Sales tab you can view and manipulate the grower return sales information which will affect the payback. You can view the details regardless of whether the payback in related to sales, but you can only change the declared value in respect of commission.

In the Grower Return:

- The actual sales price can be replaced with a ‘declared price’.

- The commission can be calculated based on the price combination of customer and vendor.

Consignment grower return line fields

These fields relate to the records associated with consignment grower return line records:

| Field name | Description |

|---|---|

| Consignment | The consignment code. |

| Trading basis | The trading basis of the consignment. |

| Pooled? | An indicator that shows whether the consignment is pooled. |

| Receipts tab | |

| Item number | The ID of the item on the consignment line. |

| Lot ID | The lot ID associated with the item if lot tracked. |

| Dimensions | Aptean F&B dimensions are displayed according to those you have selected using the Dimension display function. |

| Third-party | An indicator to show whether the item is a third-party item. |

| Received quantity | The item unit quantity received. |

| Unit | The unit in which the item quantity is shown. |

| Reference No. | The item line reference number. |

| Line | The line on the purchase order that includes the selected project and category. |

| Posted income | The value of income posted for the item. |

| Declared income | The declared income amount for the transaction in the accounting currency. |

| Posted purchase amount | The original transaction amount in the accounting currency. |

| Declared purchase amount | The declared transaction amount in the accounting currency. |

| Traded quantity | The quantity of the item traded. |

| Deductions (base) | The deductions amount. |

| Deductions (over base) | The deductions amount over base. |

| Recharge | The amount of any recharges. |

| Payback amount | The payback value for the line in the accounting currency. |

| Costs tab | |

| Entry type | The ledger transaction entry type. |

| Group id | The group ID for the entry. |

| Charge element | The code that identifies the charge element for the entry. |

| Charges name | The name associated with the charges element. |

| Cost basis | The cost basis of the entry. This will default to the one used on the grower return template but can be changed for this document. It will be either Forecast, Actual or Realized. |

| Deduct before commission | Set this option if the charge is to be deducted before commission is calculated for circumstances where commission trading bases are used. |

| Original value | The original charge value. This is the value of transaction from either the consignment ledger entries or the consignment charge lines, depending on whether the cost basis is forecast, actual or realized. |

| Declared charge value | The declared charge value. You can edit this as required. For cost lines, the system will ensure it is allocated accordingly in the correct proportions across any relevant lines. For example, if Duty was incurred in the proportion 50:50 between two raw materials lines, and the declared cost is 100, the system apportions 50 of the cost for line one and 50 for line two. If the declared cost is changed to 80, the system apportions 40:40 between the two lines. Where an original cost for outbound haulage is captured in the ratio of 100% against line one and 0% against line two and the value is changed, then the change only affects line one. For item lines, the declared value is changed if you amend the purchase value stated on the original purchase order. |

| Behavior type | The behavior type for the entry which will be either ‘Deduction’, ‘Recharge’ or ‘N/A’ depending on the template. Deductions are costs deducted from the payback, Recharges are recharged on the same purchase order as the payback using a service item attached to the charge element. |

| Income | The income for the transaction. |

| Declared income | The declared income for the transaction. |

| Costs tab | |

| Group id | This is the group ID for the consignment line. |

| Line | The line number. |

| Declared value | The declared value for the apportionment. |

| Charge element | The code that identifies the charge element for the line. |

| Description | The description of the charge element. |

| Behavior type | This indicates the behavior type of the consignment cost, for example, whether it is a deduction. |

| Cost basis | The cost basis for the line, for example, whether it is forecast or actual. |

| Deduct before commission | An indicator which set, means the cost is deducted before commission is calculated. |

| Declared amount | The declared amount for the apportionment. |

| Declared value | The declared value for the apportionment. |

| Charge element | The code that identifies the charge element for the line. |

| Charge | This is the batch number for the transaction. |

| Item number | The item number. |

| Lot ID | The code that identifies the lot. |

| Dimensions | Aptean F&B dimensions are displayed according to those you have selected using the Dimension display function. |

| Third-party | An indicator to show whether the item is a third-party item. |

| Posted quantity | The quantity of the item posted. |

| Posted amount | The value of the posted quantity. |

| Factor of apportionment | The apportionment factor. |

| Declared amount | The declared amount for the apportionment. |

| Production tab | |

| Production | The production works order number. |

| Output item id | The item id for the production output product. |

| Receipt batch | The code that identifies the receipt batch. |

| Dimensions | Aptean F&B dimensions are displayed according to those you have selected using the Dimension display function. |

| Item type | The item type code for the product. |

| Output quantity | The quantity of the product manufactured. |

| Output quantity not consumed | The output quantity of the product that is in stock. |

| Unit | The item unit. |

| Output item price | The item price of the output product. |

| Usable | Set the option if the product is usable. |

| Input/Output | Indicates whether this is an input or output. |

| Input qty | The quantity of the item used for production input. |

| Input quantity not consumed | The input quantity of the item of the output remaining. |

| % of input | The percentage of input the item represents. |

| Actual | The actual amount for the production item. |

| Declared | The declared amount for the production item. |

| Sales tab | |

| Order/Return | Indicates whether this is an order or return. |

| Sales order | The order reference. |

| Sales invoice | The sales invoice reference. |

| Customer account | The customer account code. |

| Name | The customer name. |

| Sold item | The item number for the sold item. |

| Description | The item description. |

| Qty of the sold item | The quantity of the item that was sold. |

| Unit price | The unit sales price. |

| Raw material | An indicator that shows if this is raw material. |

| Qty purchased items | The quantity of the item purchased. |

| Batch number | The batch number of the sold item. |

| Actual income | The actual income realized from the sale of the item, |

| Early payback | The early payback indicator. |

| Declared income | The value of the income you want to declare for this line. |

| Include | An indicator to determine whether this sales line is included in the grower return. |

You can use the Consignment buttons on the screen to view either consignment charge lines or consignment ledger transactions.

If you change anything on this lines form, use the Update details button to feed back the changes to the grower return.